Who can still believe that Romney is a fiscal conservative?

Take 1:

you have a president encouraging the idea of dividing America based on the 99 percent versus one percent — and those people who have been most successful will be in the one percent — you have opened up a whole new wave of approach in this country which is entirely inconsistent with the concept of one nation under God. – Mitt Romney

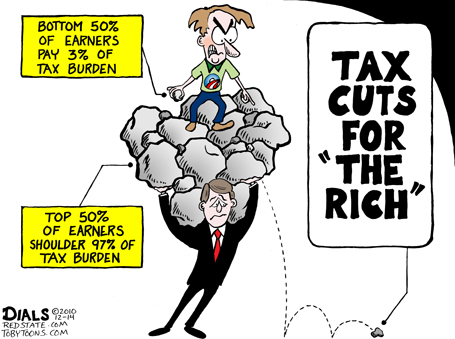

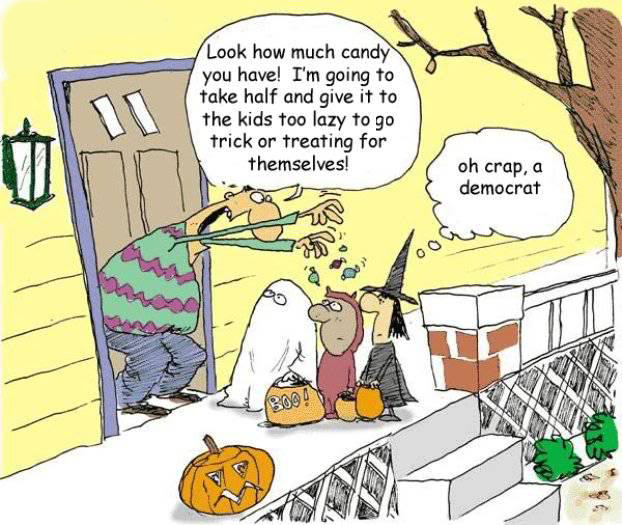

This was a representation of those on the right who have a problem with the president speaking of Americans in classes of people, and pitting them against each other. Many conservatives lean toward a flat tax or a fair tax rather than the progressive tax that penalizes those who create wealth in order to redistribute their property to those who haven’t been creating wealth.

Obama had previously proposed in his “Jobs Bill” limiting deductions on the wealthiest Americans, which would result in fewer donations to charities, and would in effect be a war on non-government charities. The idea is consistent with Obama’s perspective that government is the answer to every problem. He’s simply working on putting charities out of business. First with the “Jobs Bill” reducing contributions, now restricting the exercise of religion on employers.

In addition to dividing Americans into classes, many conservatives object to the language of people paying their “fair share.” The questions are significant: Who decides my fair share? What is “fair”? Why is my “fair share” different than someone else’s? In America, do we even have shares to pay?

Take 2: Today Romney announced his newest tax plan: Drop everyone’s tax rates except for the 1%, who need to pay their fair share:

Romney said his plan to limit mortgage interest and charitable contributions deductions would not impact middle income families. Instead, he noted, he wants to “make sure the top 1 percent keeps paying the current share they’re paying or more.”

Romney’s plan is everything he criticizes in Obama: Dividing Americans, and picking and choosing who to penalize because they aren’t paying their Fair Share.

Romney simply declared today that he is ” encouraging the idea of dividing America based on the 99 percent versus one percent — and … entirely inconsistent with the concept of one nation under God”

We have a liberal, 2 conservatives, and a libertarian running for the Republican nomination. Gingrich continues to lose steam, but will make a great advocate for conservatism. Vote Santorum.